Description

HUPX DAM (Day-ahead Market)

The HUPX Day-ahead Market enables trading of hourly and block-based electricity products for next-day delivery. Its goal is to ensure efficient competition and high liquidity, supporting the optimal use of energy resources. At the core of the market is an algorithm that considers transmission constraints and aims to maximize social welfare.

HUPX IDC (Intraday Continuous Market)

The Intraday Market aims to bring electricity trading as close in time as possible to actual delivery. Recognizing this need, HUPX launched the IDM on March 9, 2016. The market provides participants with flexibility to adjust to real-time system conditions and supply-demand dynamics.

HUPX IDA (Intraday Auction Market)

The Intraday Auction Market is a form of intraday trading conducted through scheduled auctions. Its purpose is to enable the pricing of transmission constraints that cannot be addressed in continuous trading. IDA contributes to more efficient market operation and greater predictability in electricity trading.

HUPX Trading System - MATS

MATS SIMU - hupx.mats-simu.epexspot.com/login

MATS SIMU2 - hupx.mats-simu2.epexspot.com/login

MATS PROD - hupx.mats.epexspot.com

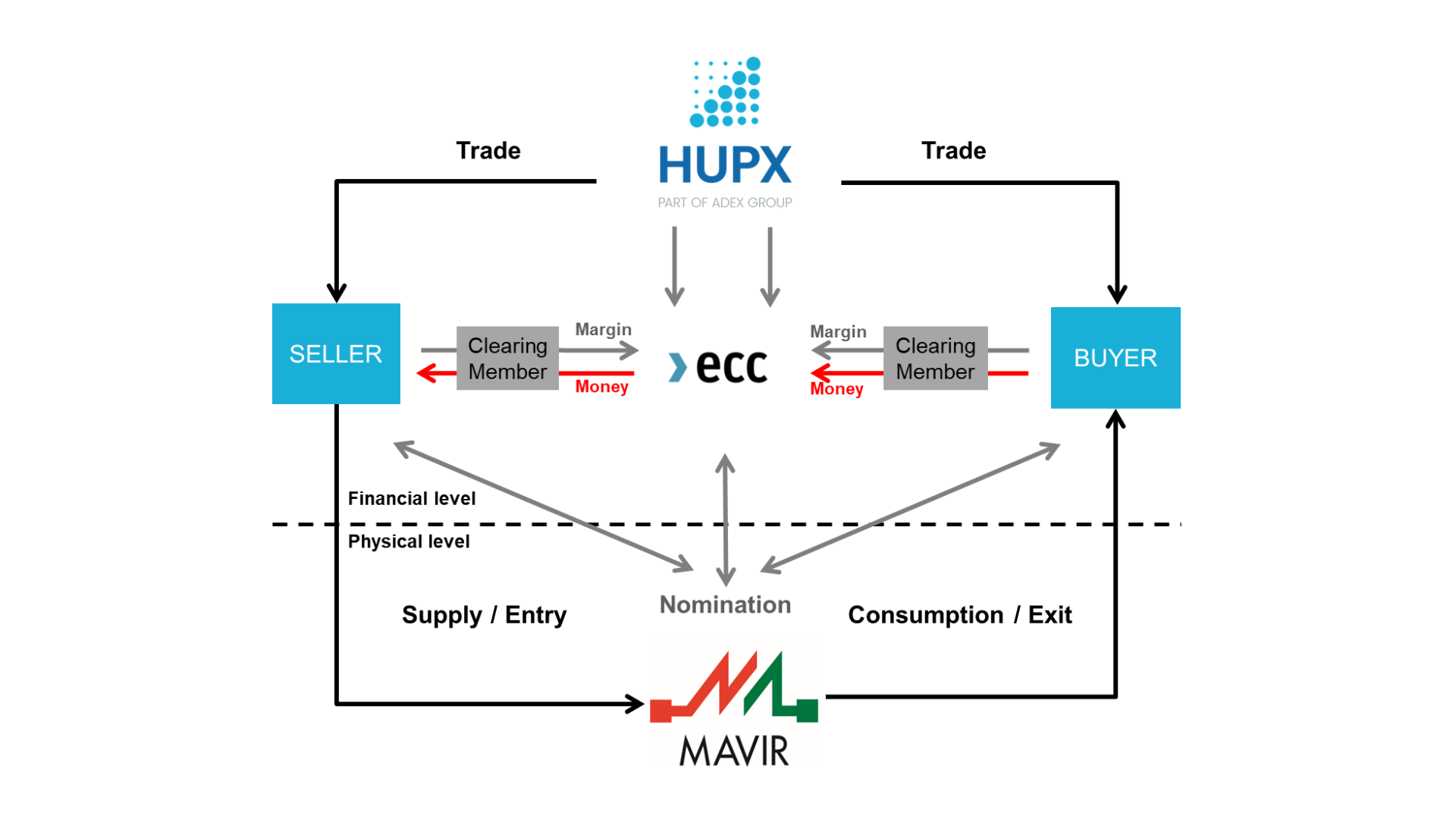

Technology & Clearing

ECC AG

European Commodity Clearing AG (ECC) is a clearing house whose range of services comprises clearing and settlement for exchange and over-the-counter transactions in energy and related products. Since its establishment in 2006, ECC has constantly expanded its range of products, its clearing membership and its exchange partnership network. Currently, ECC provides clearing services for EEX Asia, EEX, EPEX SPOT, HUPX, Norexeco, PXE, Powernext, SEEPEX and SEMOpx.

Clearing

Its automated and integrated clearing and risk management services, across a range of markets and commodities, allow ECC to standardize processes and lower collateral requirements, providing members with cross-commodity and cross-currency clearing at a reduced cost. ECC operates within a robust and international corporate governance structure and according to internationally recognized standards for capital markets, institutions and clearing houses.

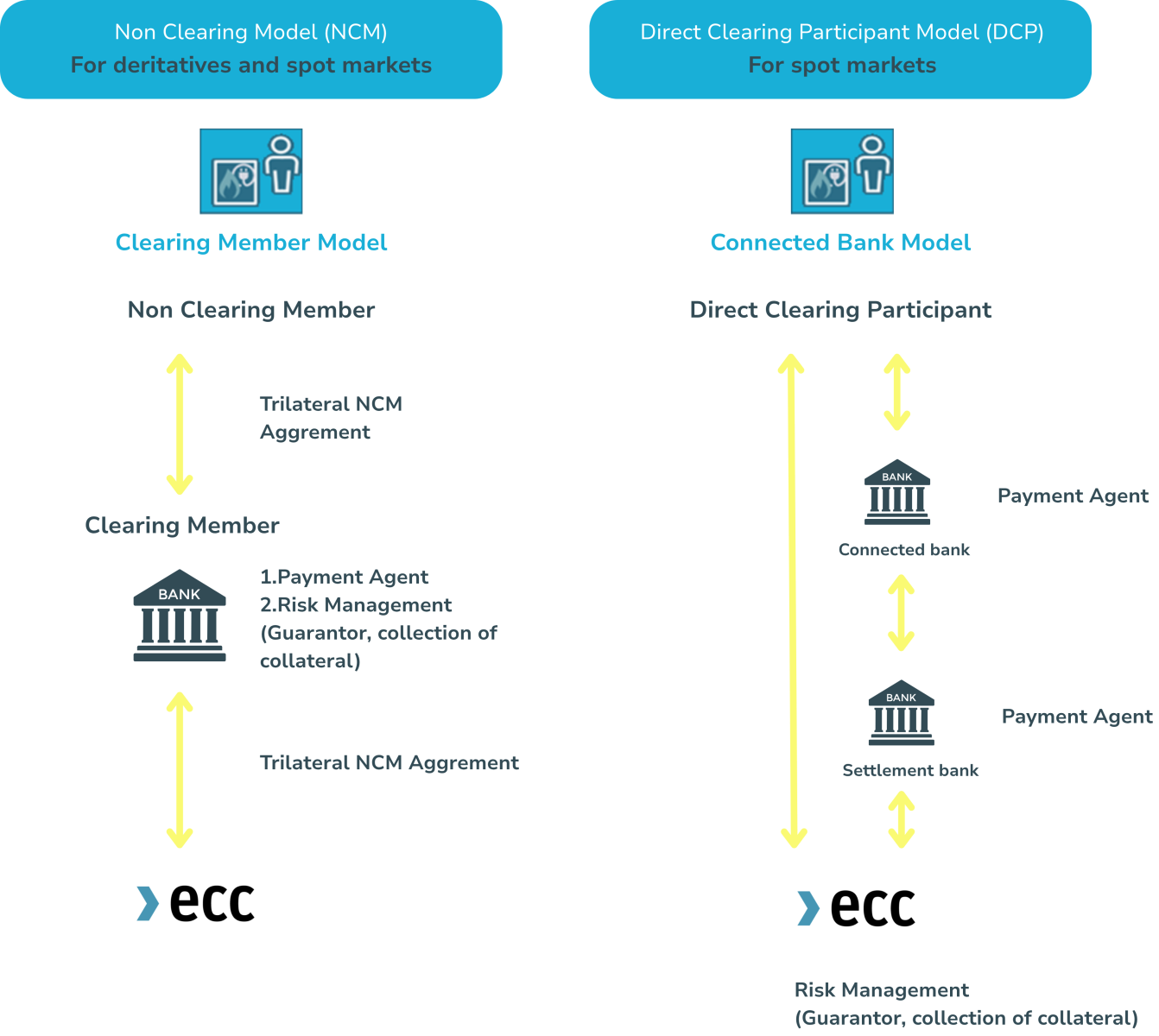

NCM and DCP models

Two types of clearing are available for the spot market members: the Non-Clearing Member model (NCM) and the Direct Clearing Participant model.

DCP Clearing Member is a Clearing Member that has a DCP clearing license, provided by ECC upon request, after appropriate member readiness procedures and is exclusively entitled to clear own spot market transactions. For the financial settlement of transactions, the DCP Clearing Member has to open a settlement account at a Settlement Bank of his choice.

Non-Clearing Members (NCMs) are companies without a clearing license. They take part in clearing as clients of a Clearing Member (CM – list of CMs available on ECC website) on the markets for which ECC provides clearing services. For the transactions to be cleared, the NCM has to contact a CM of his choice.

For more information please visit the website of ECC: https://www.ecc.de/en/access/dcp-clearing-members

Market Coupling

As Hungary’s power exchange and a licensed NEMO under MEKH, HUPX plays a central role in advancing market coupling within the European electricity sector.

What is Market Coupling?

Market coupling (implicit capacity allocation) is a key mechanism used in the European electricity market to efficiently allocate cross-border transmission capacity while optimally matching electricity supply and demand across different countries. Applying this approach, HUPX—together with all the other European NEMOs and TSOs—connects cross-border electricity markets via:

- Single Day‑Ahead Coupling (SDAC): Using the EUPHEMIA/PCR algorithm to efficiently match bids across borders in one auction.

- Single Intraday Coupling (SIDC): Real-time, continuous market operation across borders, facilitated by the XBID framework

Market coupling helps integrate national electricity markets into a unified European market, aiming to:

- Maximize the use of cross-border transmission infrastructure

- Ensure electricity flows from low-price to high-price areas

- Increase competition and liquidity

- Lower costs and improve price convergence

- Facilitate renewable energy integration

How does it work?

Market Operations and Coupling

HUPX Organized-Market Committee (OMC)

The HUPX Organized-Market Committee is an independent body of HUPX, that was established in order to ensure the state of art governance rules.

The Organized-Market Committee is a body elected from the representatives of the HUPX Members. It has an advisory role in the process of decision making on the Rules and Regulations and on general decisions related to the HUPX Market, the Hungarian organized electricity market.

Members of the HUPX Organized-Market Committee

Number | Name | Member/ Observer | Mandate starts | Mandate expires | Company |

|---|---|---|---|---|---|

1 | Nagy Lajos Péter | Member | 2024.06.01 | 2026.06.01 | E.ON Energiamegoldások Kft. |

2 | Szekeres Károly | Member | 2024.06.01 | 2026.06.01 | MVM Partner Zrt. |

3 | Darko Maksimovic | Member | 2024.06.01 | 2026.06.01 | Interenergo d.o.o. |

4 | Hiezl Tamás | Member | 2024.06.01 | 2026.06.01 | CEZ, a.s. |

5 | Lars Weber | Member | 2024.06.01 | 2026.06.01 | Nidhog Aps |

6 | Michal Kovar | Member | 2024.06.01 | 2026.06.01 | in.power Trading GmbH |

7 | Péter Luczay | Member | 2024.06.01 | 2026.06.01 | Sinergy Energiakereskedő Kft. |

8 | Trisha Paul | Member | 2024.06.01 | 2026.06.01 | Northpool B.V. |

9 | Császár Levente | Member | 2024.06.01 | 2026.06.01 | L2 Energy Trader Kft. |

10 | Németh András | Observer | 2024.06.01 | 2026.06.01 | MEKSZ |

11 | Anders Hartlev | Member | 2024.06.01 | 2026.06.01 | Energetick Aps |

12 | Katona Gábor | Observer | 2024.06.01 | 2026.06.01 | MAVIR Zrt. |

13 | Böjte Csongor | Member | 2024.06.01 | 2026.06.01 | Veolia Energia Magyarország Zrt. |

14 | Angyal Roland | Member | 2024.06.01 | 2026.06.01 | VPP Energiakereskedő Kft. |

The general principles of the Organized-Market Committee are laid in the Market Rules of HUPX under Annex VII.

Independent software vendors (ISV)

The list below contains all independent software vendor (ISV) companies, which provide software with real-time interface to HUPX Intraday trading system (M7) through API. The following access types can be requested:

- read only: retrieve market and trading data on real-time basis;

- read & write: retrieve market and trading data on real-time basis and possibility to submit orders.

The listed software are certified by HUPX following the successful completion of operational tests.

Software: Copper M7/Copper Power Platform Søndergade 43 2. tv, 8700 Horsens, Denmark Phone: + 4529367077 E-mail: mogens@copper.energy | Software: PowerBot Gersthofer Straße 29-31 1180 Wien, Austria Phone: +43 720 900018 E-mail: office@powerbot-trading.com | Software: SmartPulse 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ Phone: +44 7594 090 783 E-mail: global@smartpulse.io |

Software: Volue Algo Trader Power Richard-Strauss-Str. 82 D-81679 München, Germany Phone: +48 533 480 263 E-mail: Volue-Sales-Europe@volue.com | Software: VTC Königsallee 92 a 40212 Düsseldorf, Germany Phone: + 905356656035 E-mail: sales@vtcenergy.com |

Useful information for our members and prospect members: in case you use the software of one of the registered ISVs, you can request for an M7 API access without passing a preliminary conformance test.