How it works

- Useful readings

GO Market Monitoring Report May 2023

GO Market Monitoring Report April 2023

GO Market Monitoring Report March 2023

GO Market Monitoring Report February 2023

GO cost and revenue calculator Excel sheet

Explanatory note for Market Results publication

Market introduction

GO Presentation with multiple seller model details

HUPX GO Market - For Traders with the introduction of multiple seller model

CerQlar - HUPX GO Webinar

The workshop titled Risk Management and Market Developments, jointly organized by HUPX and CerQlar, was held online on September 11, 2024.

Agenda:

Welcome and introduction

2024 Q3 Market Updates from HUPX

An overview of the current market landscape and significant developments.

Risk Management strategies by CerQlar

Insights into effective risk management strategies using the CerQlar platform.

The NECS step for the HUPX GO market

Introduction to the NECS extension project, detailing its impact on the development and expansion of the HUPX GO market

Q&A Session

Open discussion and answers to attendee questions.

Presentations

HUPX GO market insights 2024 Q3 by Márton Gábor Kádár, Head of Sales and Business Developmemtn, HUPX

Managing Post Trade Operations by Martin Edling Andersson, Head of Product Management, CerQlar

NECS STEPS fortheHUPX GO Market by Nikolett Dancsné Ilyés, Key Account Manager, HUPX

HUPX launched the multiple seller model on 20 September 2022!

HUPX launched the multiple seller model on 20th September, since than members can buy and sell on the market under the same GO membership.

HUPX introduced the following developments with the go-live of the multiple seller model:

- 5 Order attributes: Preference handling via technology, production month, operational year, country and support type

- Available technologies: Biogas, Biomass, Geothermal, Hydro, Landfill gas, Solar, Waste, Wind and any other EECS compliant technology

- Available countries: Hungary and other AIB countries

- Seller side: Hungarian and other European power plants and GO traders besides MAVIR

- Clearing and settlement: Via HUPX technical GO account and HUPX bank account

- Guarantee system: Guaranteed delivery via collaterals for buyers and sellers

- Auction frequency: Monthly auctions

- Pricing mechanism: Single clearing price set by last winning buy Order

GO cost and revenue calculator Excel sheet

Do you want to sell or purchase GOs via HUPX? Feel free to use our indicative GO calculator Excel sheet in order to estimate potential costs and revenues based on technology, production month, country, price and GO quantity or even installed capacity.

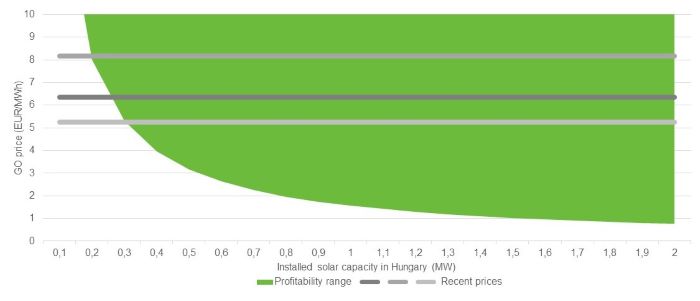

Profitability range based on prices and installed capacity - trading GOs on HUPX

Find more details in the uploaded GO cost and revenue calculator Excel sheet

Disclaimer: HUPX GO calculator Excel sheet is solely for information purposes, which contains analyst opinions and does not necessarily represent the official views of HUPX. The present Excel sheet does not count as financial advice.

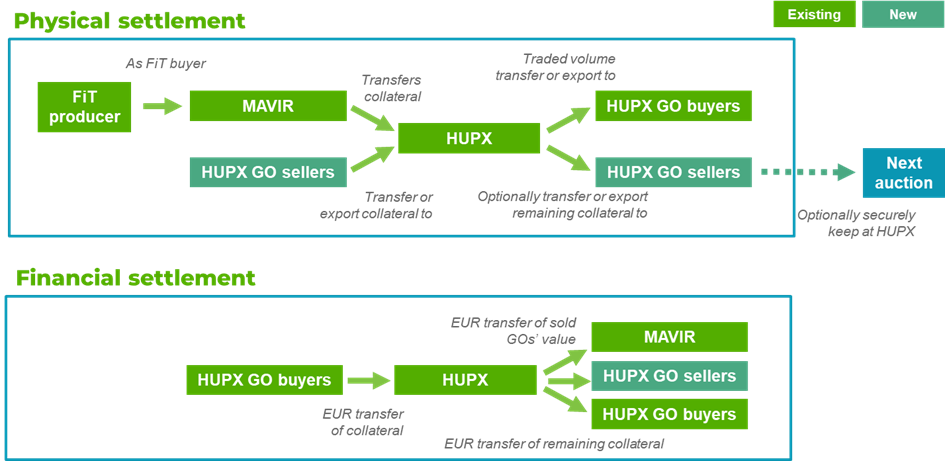

Clearing and Settlement with multiple sellers

HUPX, as the operator of the organized GO market is responsible for providing a transparent, non-discriminative and anonym trading environment. In addition, HUPX offers financial clearing and settlement services in order to ensure reliable trading processes.

More information

GO Presentation with multiple seller model details

HUPX GO Market - For Traders with the introduction of multiple seller model

HUPX GO – Primary FiT GO information (MAVIR volumes)

The HUPX GO market started with the single seller model. The Hungarian TSO (MAVIR), as the nominated buyer of Hungarian FiT production is the sole seller of the related guarantees of origins, while buyer side is open to energy traders, end-users and other market participants.

MAVIR partly offers GOs for sale regarding production period before 1st February, 2022. These are Primary FiT non-AIB GOs, which can be traded only by those HUPX GO Members, who own a Registry Account via the registry of MEKH, therefore Registry Account via other AIB Member is not eligible. Yet the Primary FiT GO Products are tradeable by every HUPX GO Member and as MEKH (Supervisory Authority) became an AIB Member from 1st February, 2022, the further and new Primary FiT GOs will be 100% EECS compliant.

HUPX regularly updates its datasheet in order to provide transparency towards market participants regarding Primary FiT GOs to be sold by MAVIR. The dataset includes the anonym list of FiT power plants, aggregated power plant data, technology codes, FiT production volumes and FiT minimum price.

Find more details in the uploaded HUPX GO – Primary FiT GO Market data sheet

Membership of MEKH in the Association of Issuing Bodies (AIB)

In February 2022 the Hungarian Energy and Public Utility Regulatory Authority (HEA) joined the Association of Issuing Bodies (AIB).

Benefits of AIB membership:

- Standardized cross-border GO trading

- PR in green markets

- Faster GO issuing and transferring

- Higher liquidity with international market participants

In Hungary GOs coming from production from 1st February 2022 comply with AIB and EECS rules.

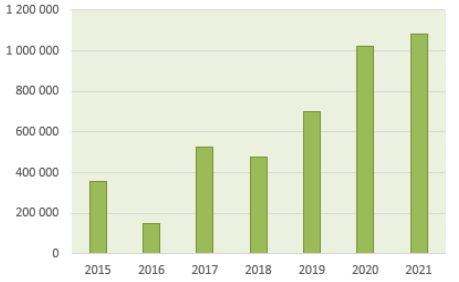

GOs cancelled in Hungary regarding Hungarian power consumption (MWh)

Source: MEKH

Archive

- HUPX-Veyt GO Webinar

Discover the latest trends and insights in the world of Guarantees of Origin (GO)!

On 23 November was hold our webinar co-hosted by HUPX and Veyt about the hot topics of European GO market!

The aim of the event was to present you the recent GO registry updates and the current market landscape. We delvedinto the developments in the GO market, went through the Scandinavian, Baltic and Central-Eastern European registry specifics and the new registries joining the European market in these regions.

Attendees were also provided with information about HUPX GO pricing and order insights in 2023 and the characteristics of the European GO market: price formation, market sentiment, outlook presented by Veyt Analyst.

The short webinar included fireside chat, market analyst presentations and Q&A sessions.

The detailed Agenda of the webinar is available HERE: >>

PRESENTATIONS and RECORDING

AIB and its Member Countries/Regions >>

HUPX GO pricing and order insights in 2023 >>

Márton Kádár, Head of Sales and Business Development, HUPXFor market updates, stay tuned, follow us on LinkedIn and subscribe our newsletter too!

#GOtradewithus

Guarantees of Origin market: price drivers and outlook for 2024 >>

Irina Peltegova, Senior Renewable Power Market Analyst, Veyt

- HUPX-ARGUS workshop - 11 April 2022

The online workshop titled „Shades of Green in Energy Trading” was organized jointly by HUPX Ltd. and Argus Media. The aim of the event was to present the current market landscape and to give information about the characteristics of our new upcoming market.

AGENDA: SHADES OF GREEN IN ENERGY TRADING

What to expect from Guarantees of Origin in the Hungarian energy sector?

HUPX as an emerging force in energy transition

10:00- 10:10 Welcome

Dr. Mátyás Vajta, CEO, HUPX

10:10 -10:35 Role of Central European countries in the European GO market

Ivar Munch Clausen, Chair of the Association of Issuing Bodies (AIB) Board

10:35 -10:50 Hungary and AIB – Changes and new possibilities

Ákos Hamburger, Head of Electricity Supervision and Licensing Department, Hungarian Energy and Utilities Regulatory Agency (MEKH)

10:50-11:05 The brand new HUPX GO Market

György Istvánffy, Director of HUPX Markets, HUPX

11:05-11:25 Guarantees of Origin Market Development and Pricing

Lawrence Templeton, VP/ Business Development Manager - European gas, power and LNG, Argus Media

11:25 – 12:15 Panel discussion: HUPX as an emerging force in energy transition

- Role of exchanges and auctions in the GO market Is price transparency enough?

- What can improve price transparency?

- How does a perfect GO product look like?

- GO preferences, subsidized or unsubsidized?

- Hungarian and regional consumer awareness – what to expect on the demand side

Moderator: Justin Colley, European Electricity Editor, Argus Media

- Filip Strohwasser, Trader, ČEZ,

- A. S. Lu Wang, Senior Trader, STX Group

- Gábor Dénes Szabó, MAVIR (Hungarian Transmission System Operator)

- Gábor Szatmári, Head of Sales, HUPX

12:15 – 12:30 Q&A

PRESENTATIONS

Role of Central European countries in the European GO market - Ivar Munch Clausen, AIB

Hungary and AIB – Changes and new possibilities - Ákos Hamburger, Head of Electricity Supervision and Licensing Department, Hungarian Energy and Utilities Regulatory Agency (MEKH)

The brand new HUPX GO Market - György Istvánffy, Director of HUPX Markets, HUPX

Guarantees of Origin Market Development and Pricing - Lawrence Templeton, VP/ Business Development Manager - European gas, power and LNG, Argus Media

Recordings of the event:

Privacy Policy for Workshop participants