Day-ahead market coupling

- THE THEORY OF THE MARKET COUPLING

HUPX is the operator of the Hungarian spot electricity market and operates as a NEMO (Nominated Electricity Market Operator) with a license issued by MEKH (Hungarian Energy and Public Utility Regulatory Authority). HUPX cooperates with other European NEMOs and TSOs (Transmission System Operators) to achieve SDAC (Single Day-Ahead Coupling) and SIDC (Single Intraday Coupling) designated by the European Commission in Regulation 2015/1222 (Capacity Allocation and Congestion Management, CACM regulation) of 24th of July 2015.

SDAC is an initiative between NEMOs and TSOs that, according to the CACM Regulation, allows cross-border trade across Europe through implicit capacity auctions for the day-ahead electricity supply.

The primary purpose of market coupling is to ensure deeper integration of regional electricity markets. Integration also serves national and international interests, as it provides higher security of supply and several benefits for consumers and traders.

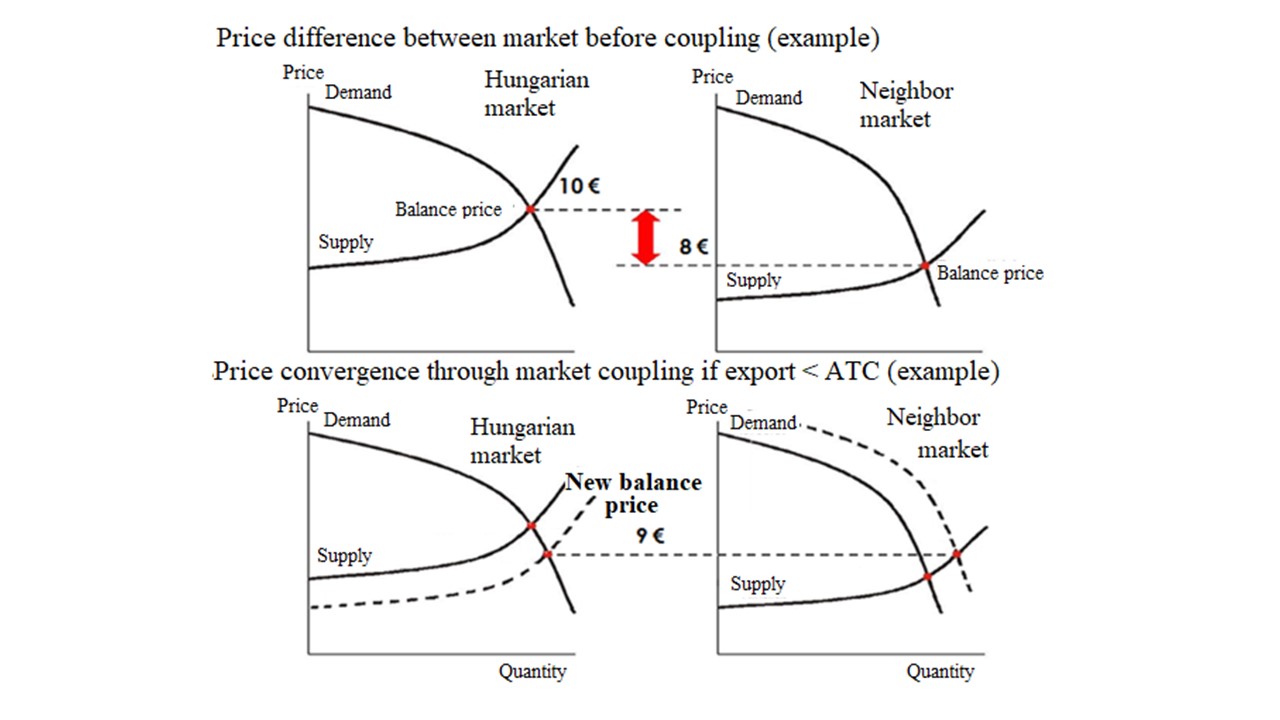

Before the introduction of market coupling, cross-border capacity and electricity had to be purchased separately. This meant that as the first step, market participants had to reserve cross-border capacity and during the second step the capacity could be used to transport the purchased electricity. Market coupling uses besides implicit auctions, in which market participants do not receive cross-border capacity allocations individually, they have to submit bids to the stock exchange for electricity. Then, during the price calculation process, power exchanges take into account the available cross-border capacity in order to minimize the price difference between different market areas.

The purpose of the market coupling process is to maximize the flow of energy from low-price areas to high-price areas, taking into account the available cross-border capacity, which optimally implies that prices area are beginning to level off in each market.

1. Figure: The advantages of market coupling

HUPX has already achieved several major milestones in the market coupling process, such as the CZ-SK-HU and the 4M MC market coupling. Following the successful launch of the Interim Coupling Project (ICP) on June 17, 2021, further important goals of the single day-ahead market are the implementation of the Flow-based project and the introduction of the 15-minute product.

- THE HISTORY OF SDAC

CZ-SK-HU market coupling

Since 30th of May 2011, when the parties signed the Declaration of intent on the planned coupling of the Czech-Slovakian-Hungarian day-ahead electricity markets, continuous work and serious efforts have been required from all parties concerned (Nominated Electricity Market Operators, Transmission System Operators and National Regulatory Authorities) to accomplish the market coupling Go Live on the first trading day of 11th of September 2012 (the first delivery day of 12th of September 2012). HUPX Zrt. worked as project manager in the implementation process of the coupling, the company acted proactively so that the initiative would start smoothly at the beginning of September, as planned.

The Czech-Slovakian-Hungarian day-ahead market coupling was based on implicit auction. During the result calculation, the Cosmos algorithm took into account the cross-border capacity available for the given day and hour as a strict limiting parameter, the value of which could not be exceeded by the amount of cross-border flow.

The Czech-Slovakian-Hungarian market coupling also ensured the possibility of efficient connection to the MRC region. The CZ-SK-HU market interconnection took off on 11th of September 2012. The CZ-SK-HU market coupling was a foresight and significant initiative for the full coupling of European markets.

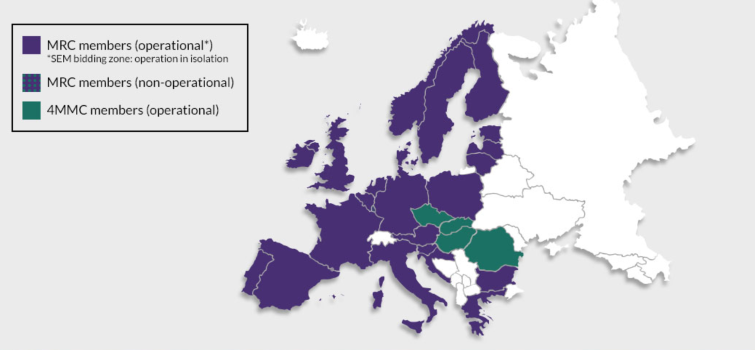

The CZ-SK-HU-RO market coupling (4M MC)

The project was launched in August 2013 with the purpose of extending the CZ-SK-HU market coupling to Romania and implementing the PCR (Price Coupling of Regions) solution. After all parties involved had already applied the PCR solution, on 19th of November 2014, the Czech, Slovak, Hungarian and Romanian stock exchanges, as well as the TSOs and NRAs, started the day-ahead coupling (4M MC) operation. The 4M MC is an ATC-based day-ahead implicit allocation procedure that seeks the highest possible compatibility with the EU target model.

The Go Live launch took place on 19th of November 2014, after successful market participant tests and acceptance tests, as well as final regulatory approval, another milestone in the execution of a single European day-ahead electricity market.

2. Figure: MRC and 4M MC members in SDAC during spring 2021 (before ICP Go Live)

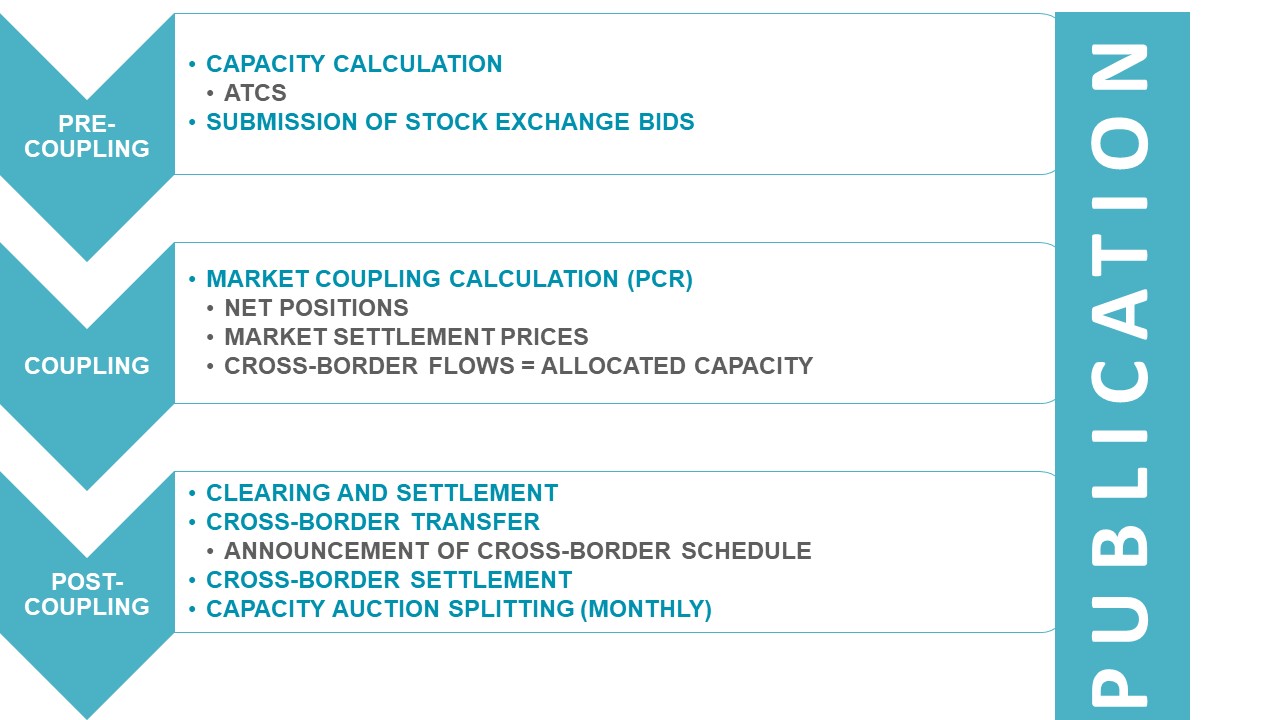

The market coupling design in the 4M MC

The introduction of market coupling did not change the methodology for calculating capacity. The process continued as follows: On a border both neighboring Transmission System Operators (TSOs) calculated the ATC and the smaller value was taken into account to calculate the final result and then publish it. In the countries, each TSO (ČEPS, SEPS, MAVIR and TEL) coordinated cross-border capacities, while the management of market capacities was already the responsibility of a Modified TSO Management Function (mTMF). The coordinated capacity calculation was performed by SEPS.

It is the responsibility of the electricity markets to receive bids from market participants, which transmit the data anonymously to the relevant PMB entity (Price Matcher and Broker).

In order to trade in the 4M MC market coupling, it was not necessary to register on all PXs, only in one local market. Market participants used the local PX system making bids and request results. The price matching application - which ensures the operation of the market coupling - was based on the EUPHEMIA algorithm, which was also developed and used by PCR in the Multi Regional Coupling (MRC) region. In addition, the PMB received the available capacities transmitted by the mTMF and then matched the bids on the basis of the aggregated data. This process involved the implicit handling of capacities and bids. The submission of cross-border schedule to the system of TSOs was carried out by “shippers” (TSOs), but it was also their responsibility transmitting electricity between neighboring markets. During the implementation, the parties aiming to develop an implementation as close as possible to the MRC solution, while adapting the 4M MC (e.g.: maintaining an 11:00 bid submission deadline on the PX side). Furthermore, the parties have agreed to maintain the same roles and responsibilities - where possible and reasonable – based on CZ-SK-HU MC contractual framework (e.g.: centralized TSO system and cross-border supply of energy supplied by TSOs).

3. Figure: 4M MC market coupling design

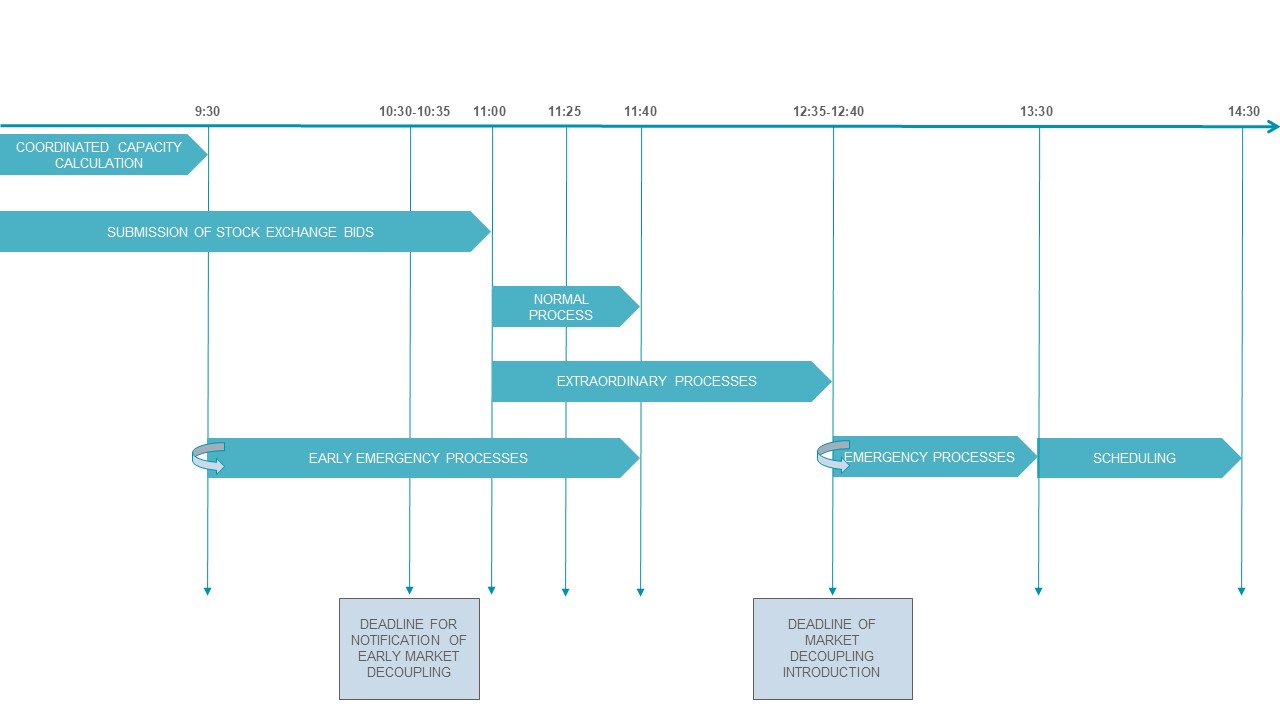

During the design phase of the operational processes and timings, the project participants primarily sought to offer an effective solution to any problem. In terms of processes, this is served by the backup processes set up for minor delays (backup modes).

4. Figure: 4M MC Processes and timings

Interim Coupling Project – ICP

On 21st of December 2018, the National Regulatory Authorities of Austria, Germany, Poland and the 4M MC countries (Czech Republic, Hungary, Romania, and Slovakia) initiated the implementation of the NTC-based market coupling project between these countries, i.e. the Interim Coupling Project. Following the finalization of the High-Level Market Design by the DE-AT-PL-4MMC countries –the participants of Interim Coupling Project- one meeting was held in Budapest on 22nd of May 2019 by NRAs, TSOs and NEMOs and they confirmed their support for continuing the project. As a result, the Interim Coupling Project was successfully launched on 17th of June 2021.

The project aims to connect 4M MC region, Poland and the Multi Regional Coupling Region (MRC) by introducing NTC-based implicit allocation on 6 new borders (PL-DE, PL-CZ, PL-SK, CZ-DE, CZ-AT, and HU-AT). The Net Transfer Capacity (NTC) calculation method is based on the calculation of the transmission capacity of maximum amount of electricity that can be transferred between the two zones. The calculation method is compatible with the security standards required for the specific areas and takes into account the technical uncertainties related to future network conditions.

5. Figure: NTC-based capacity allocation at 6 new frontiers after interconnection of 4MMC and SDAC

The Interim Coupling Project is a temporary solution in the process of market coupling for the mentioned borders. The purpose is to move from NTC-based explicit allocation to flow-based implicit allocation, which the parties intend to achieve under the Core Flow-Based Market Coupling (Core FB MC) Project.

The Interim Coupling Project has completed the SDAC “enduring phase”, in which there is only one single European day-ahead market coupling.

- SINGLE DAY-AHEAD COUPLING - SDAC

The Single Day-Ahead Coupling (SDAC) aims to create a single pan-European cross-border day-ahead electricity market. An integrated day-ahead market facilitates effective competition, increases liquidity and is able to use of energy generation resources more efficient across Europe.

SDAC allocates limited cross-border capacities as efficiently as possible: wholesale electricity markets from different regions are coupled by a common algorithm (PCR EUPHEMIA) that continuously takes into account cross-border transmission constraints and maximizing social welfare. The purpose of Price Coupling of Regions (PCR) is to calculate electricity prices across Europe using a single, common tool to implicitly allocate cross-border capacity on auctions. The PCR solution is currently owned by nine power exchanges: EPEX SPOT, GME, HenEx, NASDAQ, Nord Pool, OMIE, OPCOM, OTE and TGE. The shorter version of Pan-European Hybrid Electricity Market Integration Algorithm is EUPHEMIA algorithm.

Market coupling process in SDAC

Normal operation and timing

Process of normal daily operation:

The actual market coupling happens between 12:00 and 12:57, which starts with closing of the gate (Gate Closure Time, GCT, 12:00, in case of a technical issue the GCT is 12:20 pm CET) and ends with the publication of the final results at 12:57. Market participants then receive the preliminary market results at 12:45 p.m.

6. Figure: Normal operation of SDAC

Decoupling types and timings

Partial decoupling and timings in SDAC

If the market integration process cannot be completed in time and the results cannot be delivered according to normal operation, various emergency processes will be activated for troubleshooting.

Two main decoupling cases on SDAC level:

- partial decoupling

- full decoupling

Forms of partial decoupling:

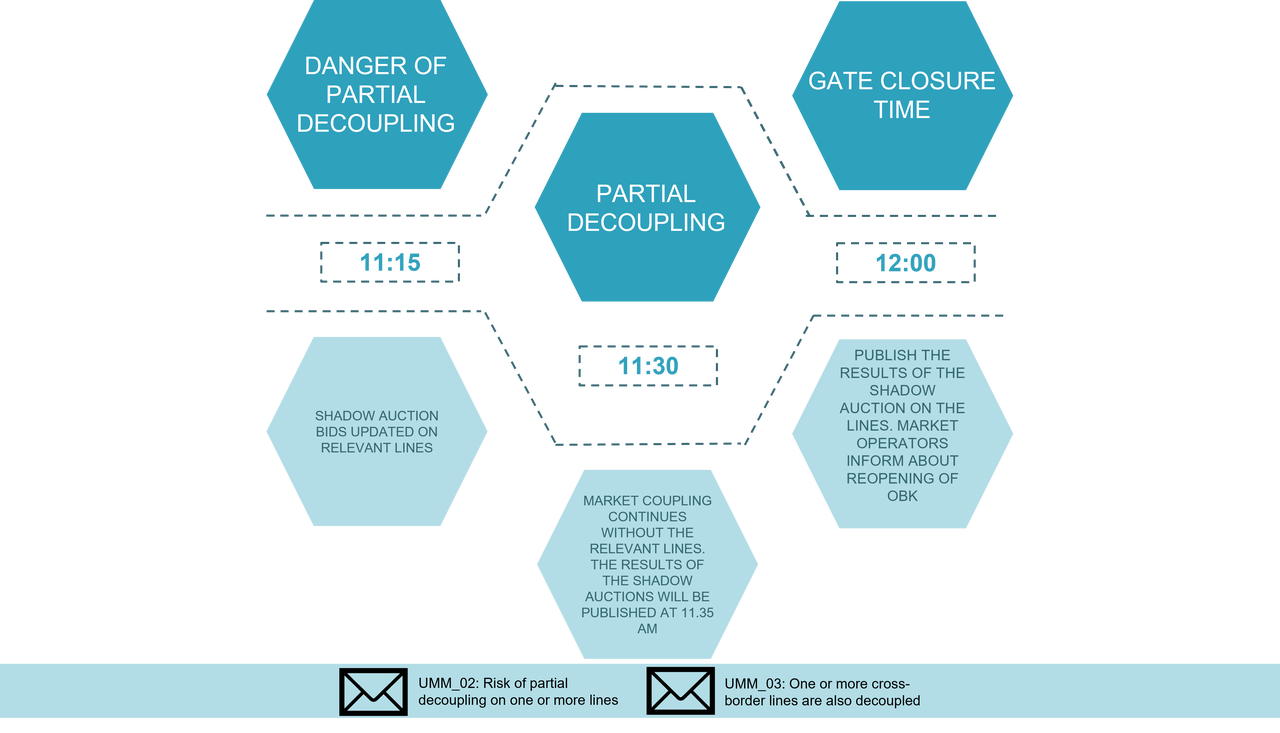

1. If the problem is not solved, operators shall receive a message of partial decoupling at 11:30 and the process should continue without the relevant cross-border lines. The results of the shadow auctions will be published as soon as possible after the partial decoupling becomes official at 11:35. If the partial decoupling is due to a problem during the CZC process, i.e. early disconnection:

If there is a risk that one or more cross-border transmission lines will be decoupled, operators will be notified at 11:15 of the risk of partial decoupling of one or more lines. This message includes all relevant wires. Then the JAO will draw the attention of market participants to the possibility of participating in the shadow auction.

7. Figure: The operation of SDAC in case of one or more cross-border lines decoupled

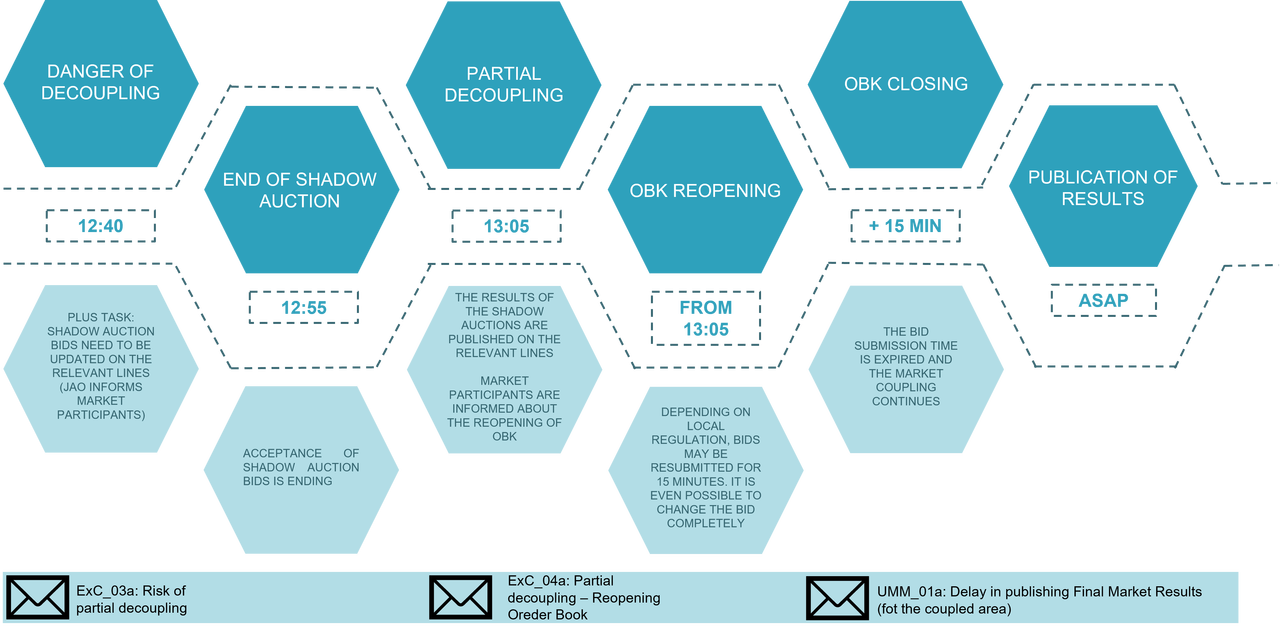

2. If the partial decoupling is due to a problem during the market coupling process:

If there are technical problems in the trading system of one or more NEMOs and they are not able to continue the market coupling process, partial decoupling will be realized in the relevant bidding zones. Operators will be informed at 12:40 of the risk of partial decoupling. The JAO will inform market participants about the possibility of shadow auctions and their submission deadline, which is 12:55 p.m. If the technical problem is not solved, the partial decoupling will become official at 13:05 by sending the appropriate message to participants.

The results of the shadow auction will be published at the same time as the other results. Whichever causes the partial decoupling, the Order Book can be reopened for 15 minutes.

Once the submission of bids is completed, the market coupling continues with the appropriate delay and the results will be published as soon as possible. Decoupled NEMOs will run their local auctions and will publish their Local Market Results independently from the NEMOs remaining in Interim Coupling.

8. Figure: The operation of SDAC in case of decoupling of more or more bidding zones

Full decoupling and timings in SDAC

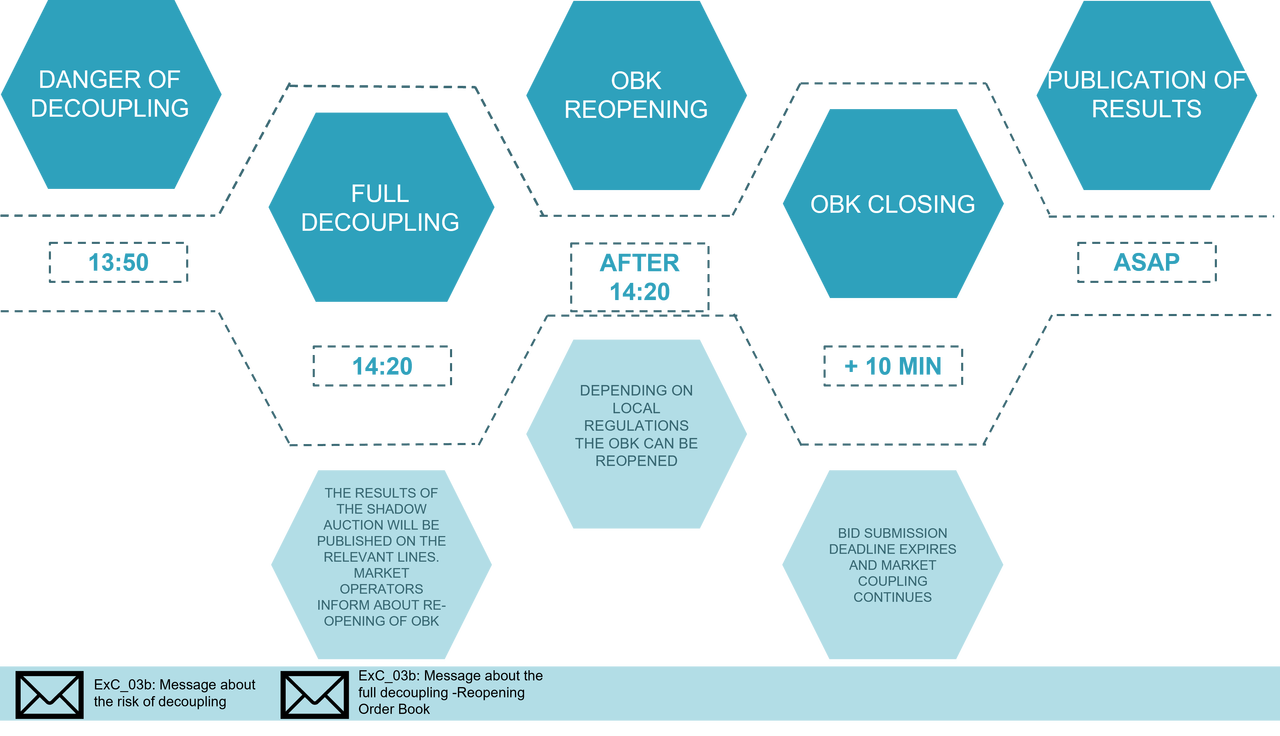

There could be full decoupling if critical deadlines cannot be held and there is no part of the market that can be coupled.

9. Figure: The operation of SDAC in case of decoupling of more or more bidding zones

Full decoupling in the SDAC occurs when no bidding zones and cross-border capacity could remain coupled due to the lack of appropriate market coupling result by the 14:20 deadline.

Market participants receive a message at 13:50 about the danger of full decoupling. Bid auctions can be updated until 14:10. The message that the complete decoupling is official is sent at 14:20.

The process is then the same as the partial decoupling. Local auctions are conducted with explicit shadow capacity auctions. The Order Book will be reopened after 14:20 and the results will be published as soon as possible.

- CORE FLOW-BASED MARKET COUPLING

According to the Article 20 of Commission Regulation (EU) 2015/1222 (CACM Regulation) - which provides guidance on capacity allocation and congestion management - in the Core Capacity Calculation Region, Flow-based (FB) capacity calculation market coupling has to be implemented for the day-ahead market.

In May 2015, the Transmission System Operators in the CWE region (Belgium, France, the Netherlands and the German-Austrian-Luxembourg bidding area) successfully applied the FB method. On 2022.06.08, the flow-based capacity calculation method was implemented in the Core CCR region, which consists of the borders of the following EU Member States: Austria, Belgium, Croatia, the Czech Republic, France, Germany, Hungary, Luxembourg, the Netherlands, Poland, Romania, Slovakia and Slovenia.

10. Figure: Core Flow-based market coupling participants

The flow-based approach is a capacity calculation method in which the physical constraints of the network are based on the availability of critical network elements (branches) and Power Transfer Distribution Factor (PTDF) for all critical branches and bids of Core CCR. These factors describe how the net position (import or export) of each bidding zone changes the energy flow in each critical branch. After that, the algorithm looks for the most optimal electricity trading option among the bidding zones. The Flow-based method further increases social welfare compared to the net transmission capacity (NTC) method. The Flow-based method is more sophisticated because it takes more parameters into account and optimization states, therefore it tracks actual network conditions better. More detailed information is available here.

Market integration

The energy transition towards a carbon free electricity supply is a European challenge that requires the use of the European electricity system to the full extent. Weatherdependent supply and increasing demand response will lead to a different and more intense use of the grid. The Core market integration project is aiming to create operational preconditions to optimise the use of the system from a regional perspective and make the single European market a reality.

Market coupling process in Core

11. Figure: Market coupling process in Core

- THE FUTURE DEVELOPMENTS OF SDAC

PCR EUPHEMIA already fulfils a several CACM requirements, the final purpose is completing the SDAC and implementing all CACM requirements. Furthermore, PCR EUPHEMIA has been proposed as an “existing solution” for the pricing of an intraday market coupling project (IDA), i.e. for the execution of intraday auctions. Regarding the EUPHEMIA algorithm is currently proceeding several developments, including the further extension of market coupling, the implementation of new market plans and ensuring appropriate running times:

- Geographical extension and market growth;

- Switching from NTC to Flow-based capacity calculation method;

- Introducing the 15 MTU product and pairing products with different market time units;

- Fulfilling the relevant CACM requirements for the algorithm (appropriate running time, scalability, repeatability);

- Performing new NEMO and TSO requirements;

- Implementation of topological changes.

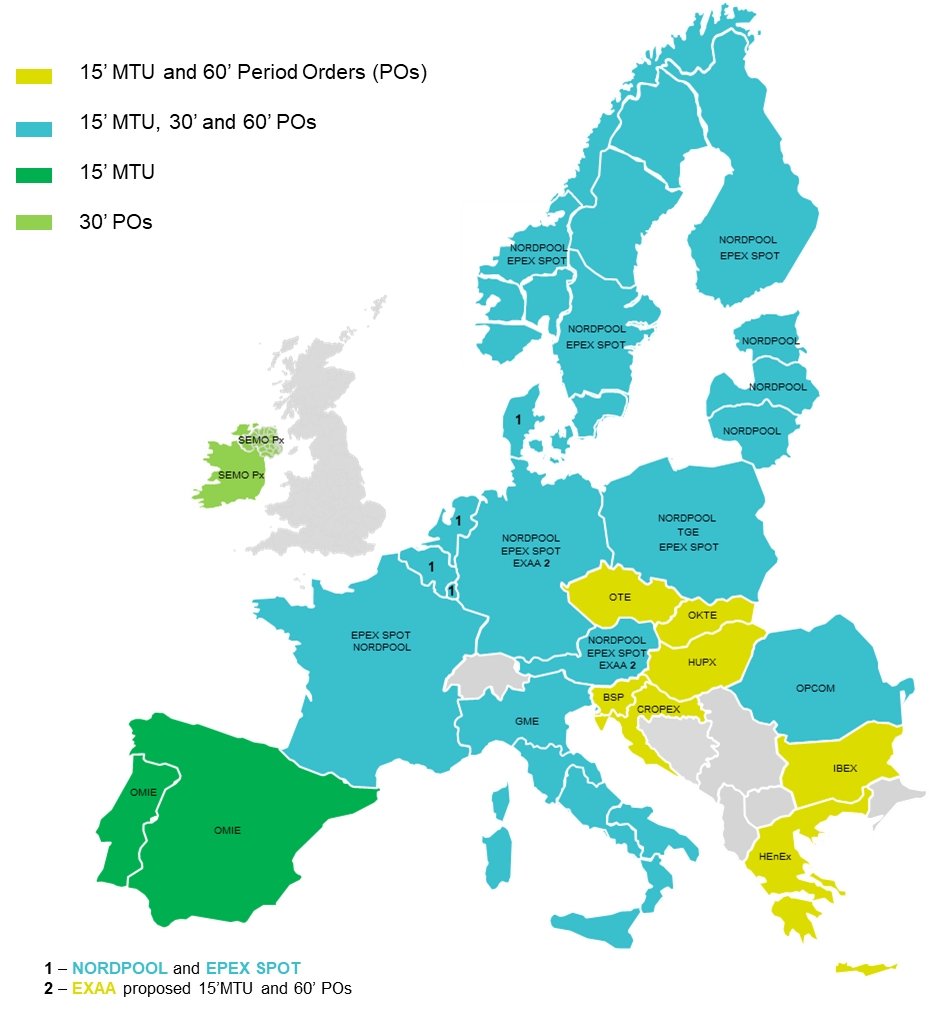

15 min MTU implementation

15-minute Market Time Unit (MTU) will be introduced on all borders and in all Bidding Zones in Europe for Single Day-Ahead Coupling (SDAC) in 2025. For the Single Intraday Coupling (SIDC), 15-minute MTU is already available in some Bidding Zones and at some borders, and will be gradually extended to all bidding zones and borders in 2025.

Through Article 8 of the Clean Energy Package (CEP), the European Commission obliged NEMOs to provide market participants with the opportunity to trade energy in time intervals which are at least as short as the imbalance settlement period (ISP) for both day-ahead and intraday markets.

The transition to the 15-minute Market Time Unit (MTU) in the Single Day-Ahead Coupling (SDAC) marks a significant milestone in the evolution of Europe’s energy markets:

- Enhanced Integration of Renewable Energy Sources: Shorter MTUs allow for more precise scheduling and dispatching of variable renewable energy, such as wind and solar, whose outputs fluctuate within shorter time frames.

- Improved Grid Stability: A finer time resolution aids in better forecasting and balancing of supply and demand, reducing imbalances and enhancing overall grid reliability.

- Increased Market Efficiency: Market participants can engage in more granular trading, optimizing their positions and responding more effectively to market signals.

The implementation of this shorter granularity aims to enhance the accurate bidding patterns enabling better integration of renewable energy sources, and promoting increased market efficiency and flexibility, potentially lowering costs ultimately benefiting market participants.

All information stemming from the Market Coupling Steering Committee (MCSC) in relation to the go-live of 15-minute contracts in SDAC and SIDC is published on the website of the All NEMO Committee here .

The following methodologies and documents related to 15' MTU were published by NEMOs:

SDAC Product Methodology https://www.nemo-committee.eu/publication-detail/day-ahead-product-methodology Algorithm Methodology https://www.nemo-committee.eu/publication-detail/algorithm-methodology SDAC and SIDC IDAs algorithm description link to document HUPX will, as well as targeted, introduce 15-minute MTU on all SDAC Day-Ahead markets subject to successful testing and member readiness.

A more detailed planning available here: link.

The Day-Ahead coupled auction at 12:00 CET, for delivery on the next day, will switch from 60-minute MTU to 15-minute MTU in all SDAC bidding zones and for all bidding zone borders at the same time.

To maximize trading opportunities, Cross Product Matching will be offered. This service will allow Market participants to bid in 60-minute or 15-minute regardless of the minimum time unit of the market, ensuring that orders from different time resolutions can be matched together.

Infosheet on 15 min MTU is available here: link.

Market Coupling Documentation

Additional Documentation can be accessed via the chart below and on the website of the NEMO Committee.

6th MCCG supporting document link to document 6th MCCG Q&A link to document 7th MCCG supporting document link to document 7th MCCG Q&A link to document MCCG on SDAC 15-min MTU supporting document link to document GO/NO-GO Decision for Member Test’ Start link to document Confirmation of starting member testing link to document SDAC 15-min MTU Information Package link to document Press Release on Market Coupling Steering Commmitte Alignement on Revised Go-Live Date for 15-Minute MTU link to document Mccg webinar - 2 June 2025 link to document SDAC 15-Minute MTU Go-Live: Information for Joint Members’ Testing Phase link to document