Intraday continuous market

- THEORY OF MARKET COUPLING

HUPX is the operator of the Hungarian spot electricity market and operates as a NEMO (Nominated Electricity Market Operator) with a license issued by MEKH (Hungarian Energy and Public Utility Regulatory Authority). HUPX cooperates with other European NEMOs and TSOs (Transmission System Operators) to achieve SDAC (Single Day-Ahead Coupling) and SIDC (Single Intraday Coupling) designated by the European Commission in Regulation 2015/1222 (Capacity Allocation and Congestion Management, CACM regulation) of 24th of July 2015.

SIDC is an initiative between NEMOs and TSOs that, according to the CACM Regulation, allows cross-border trade across Europe through implicit capacity auctions for the intraday electricity supply.

The primary purpose of market coupling is to ensure deeper integration of regional electricity markets. Integration also serves national and international interests, as it provides higher security of supply and several benefits for consumers and traders.

Before the introduction of market coupling, cross-border capacity and electricity had to be purchased separately. This meant that as the first step, market participants had to reserve cross-border capacity and during the second step the capacity could be used to transport the purchased electricity. Market coupling uses implicit auctions, in which market participants do not receive cross-border capacity rights individually, they only have to submit bids to the local power exchange for electricity.

- THE HISTORY OF SIDC

After the approval of the Third Energy Package, and with the higher percentages of the renewable electricity production, the introduction of Intraday Market Coupling became more urgent. To decrease the balancing energy consumption it is important to provide solutions for traders to trade electricity as close to real time as possible. In June 2014, six power exchanges (APX, BELPEX, EPEX SPOT, GME, Nord Pool, OMIE) agreed to establish the Intraday Market Coupling to which relevant TSOs joined later. This cooperation became known as XBID (Cross Border Intraday). After the approval of the MCO Plan (Market Coupling Operator Plan), the XBID project was recognized as the European target model of the Single Intraday Coupling (SIDC). According to the model, all NEMOs need to take part in this cooperation.

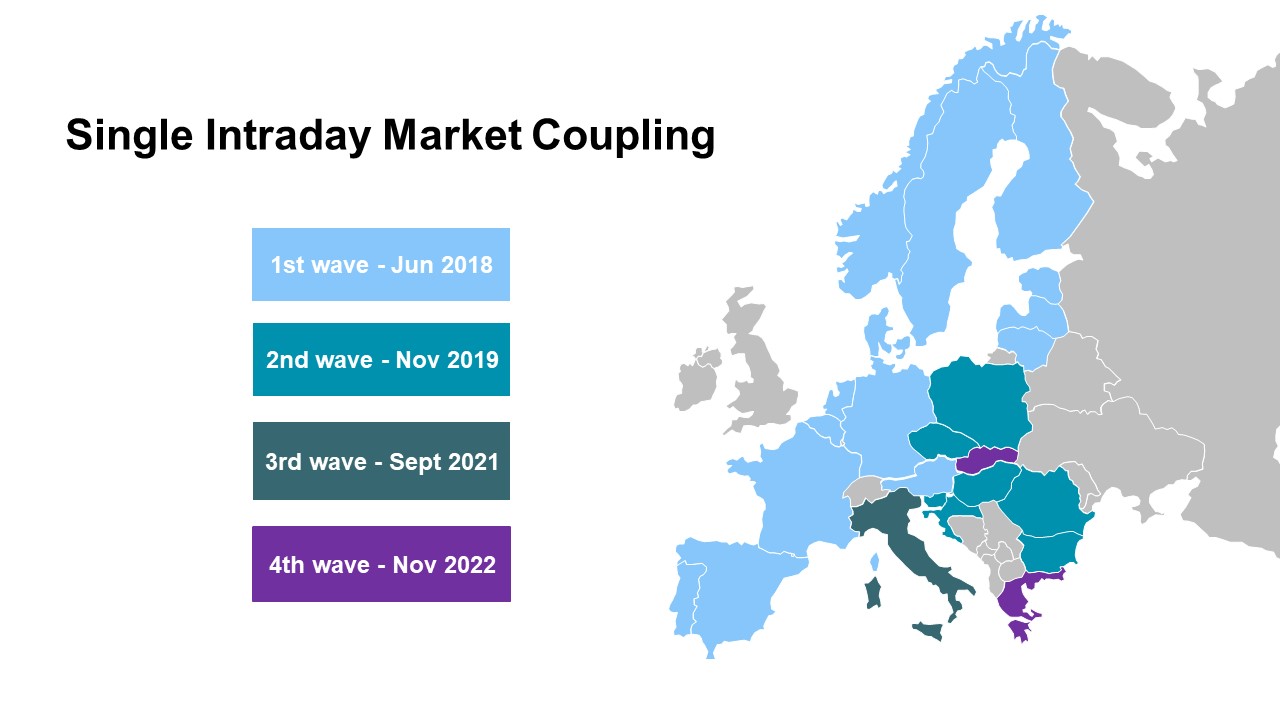

SIDC has been expanded in several phases, referred to as “waves”. The first wave went live in June 2018 and included 15 countries. The second wave with seven further countries – including HUPX - was achieved in November 2019. The third wave integrated Italy in September 2021, the fourth wave happened in November 2022 when Greece and Slovakia joined the SIDC.

The map below shows the countries participating in the SIDC and the date of their integration:

1. Figure Go-live waves of the Single Intraday Market Coupling

- SINGLE INTRADAY MARKET COUPLING SIDC

An integrated intraday electricity market is promoting effective competition and pricing, increase liquidity and enable a more efficient utilisation of the generation resources across Europe. With the increasing amount of intermittent production, it becomes more and more challenging for market participants to be in balance after the closing of the Day-Ahead market. Therefore, interest in trading in the intraday markets is increasing. Being balanced on the network closer to delivery time is beneficial for market participants and for the power systems alike by, among others reducing the need of reserves and associated balance energy costs eventually paid by end consumers.

SIDC is based on a common IT system with one Shared Order Book (SOB), a Capacity Management Module (CMM) and a Shipping Module (SM). This means that orders entered by market participants for continuous matching in one country can be matched by orders similarly submitted by market participants in any other country within the project’s reach as long as cross-border transmission capacity is available. The intraday solution supports both explicit (where requested by NRAs) and implicit continuous trading and is in line with the EU Target model for an integrated intraday market. The purpose of the SIDC initiative is to increase the overall efficiency of intraday trading. The system provider of SIDC solution is Deutsche Börse AG (DBAG).

2. Figure High level architecture of SIDC

The orders submitted by the market participants of each NEMO via the Local Trading Solution (LTS) of the respective NEMO is centralised in the SOB. Similarly, all the intraday cross-border capacities are made available by the TSOs in the CMM. It is important to clearly distinguish between Local Trading Solutions (LTSs) and the SIDC Solution: LTSs represent an interface (the only interaction point) between the Implicit Market Participants and the Single Intraday Coupling (SIDC) Solution. In other words, the Implicit Market Participant may access the SIDC only via the LTS of a particular NEMO. The SIDC Solution is a so-called backend system, which does not interact with the Implicit Market Participants. It provides, among others, a functionality of the Shared Order Book via interaction with the connected LTSs.

Order books displayed to the market participants via the LTS provided by their NEMO(s) is containing orders coming from other participants of the concerned NEMO and also orders coming from other NEMOs subject to cross-border matching, provided there is enough cross-border transmission capacity available. Among others the NEMOs’ trading systems provide the following features:

- It shows to its market participants the local view, i.e. the order book that the market participants can view in each area according to the available capacity on the borders.

- It sends the anonymized orders to the SOB received from their market participants. A ‘trading solution client’ is provided by the NEMOs to their market participants for their activities on the market (submit orders, receive trade information, etc.).

- It receives the required information from the SIDC solution (matching results, local view, etc.).

- It provides the required information to the market participants and to its clearing system.

Orders submitted in different market areas can be matched provided there is enough capacity available on the borders. In such a case, order matching will result in an implicit capacity allocation. Concretely, when two orders are being matched the SOB and CMM will be updated immediately. The trading principle remains first-come first-served where the highest buy price and the lowest sell price get served first. The update of SOB will mean that the orders that were matched are removed, and consequently that the available transmission capacity in the CMM will be updated. The number and location of the borders where the capacities are updated will follow the cross-border flows originated by the geographical location of the matched orders.

The SM of the SIDC Solution provides information from trades concluded within SIDC to all relevant parties of the post-coupling process. The SM receives data from the SOB about all trades concluded: between two different Delivery Areas and in the same Delivery Area between two different Exchange Members.

Delivery hours covered by SIDC for each bidding zone border are 24/7. The 24/7 availability of the system can be guaranteed since both CMM and SOB have a primary and a back-up system that are separated physically to ensure highest availability of the system. Trading at local intraday platforms and the explicit access to the CMM is not affected by a down-time of the SOB. The normal operation of SIDC and the Hungarian bidding zone and scheduling area is summarized below:

3. Figure Daily operation of SIDC

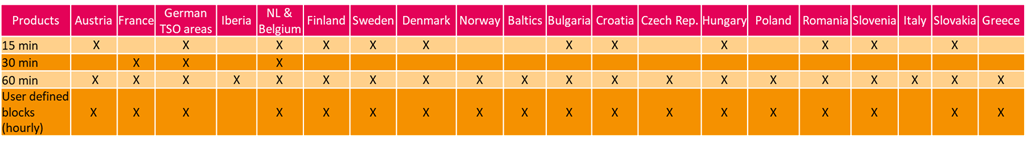

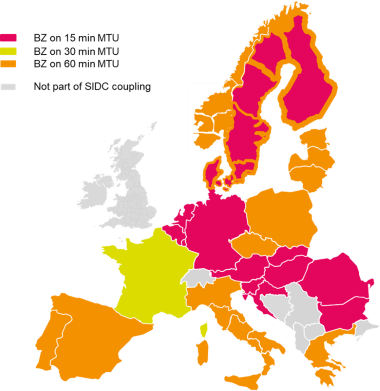

SIDC system supports the following products:

- 15-minutes

- 30-minutes

- 60-minutes

- Hourly User Defined Blocks

Products are configured to the SIDC solution per market area. Specific product availability in different market areas is detailed in the table below:

4. Figure SIDC products

Size: minimum volume increment 0,1 MW

Price tick: EUR 0,01/ MWh

Volume range: from 0,1 MW to 999MW

Price range: from -9999 EUR/MWh to 9999 EUR/MWh,

60-min products are available in every SIDC country.

30-min products are currently tradable across the borders FR-DE, DE-NL, DE-BE, FR-BE and BE-NL.

15-min products are currently tradable across the borders BE-NL, BE-DE, NL-DE, AT-DE, AT-HU, AT-SI, HU-RO, BG-RO, SK-HU, HU-SI, HR-HU and HR-SI.

15-min products are available within DK, SE, Fi internal bidding zones, but not cross-zone / cross-border.

The availability of 15-minute products across other market areas will further expand in the future.

In case of failure of the SIDC solution the intraday trading still remains possible internally within each bidding zone, provided local trading is offered by the NEMOs. Measures have been taken to achieve a high SIDC solution availability and this has proved to be the case during the first years of operation.

- THE FUTURE DEVELOPMENT OF SIDC

SIDC already fulfils a several requirements; NEMOs and TSOs are currently proceeding several developments, including the further extension of market coupling, implementing all CACM requirements and ensuring appropriate and efficient operation of SIDC solution:

- Geographical extension and market growth

- Introduce cross-zonal capacity pricing through intraday auction (IDA) for pricing intraday cross-zonal capacity.

- Implement the functionality to address losses on HVDC cables

- Implement flow-based capacity calculation and allocation in continuous trading

Intraday Auctions (IDAs)

In accordance with the Article 55 of Commission Regulation (EU) 2015/1222 CACM “Pricing of intraday cross-zonal capacity” as well as to respond to the local needs of the market HUPX is committed to establish the intraday auctions ("Intraday Auctions, IDA") in Hungary, which will be part of the Single Intraday Market Coupling (SIDC) and completes the continuous trading.

The single methodology for pricing intraday cross-zonal capacity shall reflect market congestion. The IDAs shall be organized as implicit auctions where collected orders shall be matched and cross-zonal capacity shall be allocated simultaneously for different bidding zones. IDAs shall take into account all valid orders submitted for the respective auctions and determine a clearing price for the relevant bidding zones based on matched orders. 3 IDA shall be held:

- IDA 1: on the day D-1 for all MTUs of the delivery day D, with a deadline for bid submission at 15:00 CET, D-1.

- IDA 2: on the day D-1 for all MTUs of the delivery day D, with a deadline for bid submission at 22:00 CET, D-1.

- IDA 3: on the day D for all remaining MTUs of the delivery day D, with a deadline for bid submission at 10:00 CET, D.

As the forthcoming Intraday Auction (IDA) will use the algorithm Euphemia, for the future R&D a cooperation shall be ensured between SDAC and SIDC.